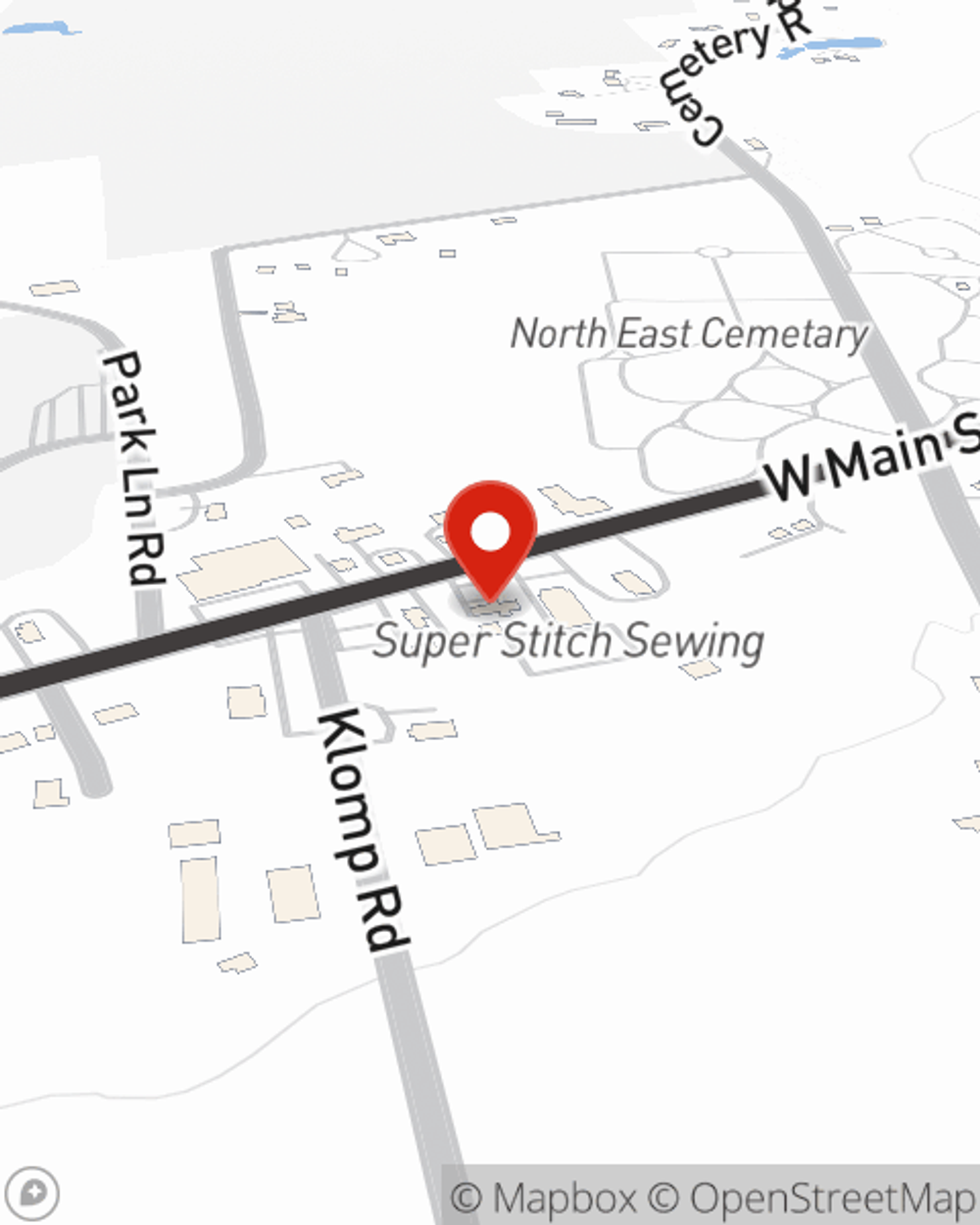

Business Insurance in and around North East

Looking for small business insurance coverage?

Cover all the bases for your small business

Your Search For Fantastic Small Business Insurance Ends Now.

Whether you own a a flower shop, a pet groomer, or a tailoring service, State Farm has small business coverage that can help. That way, amid all the different moving pieces and options, you can focus on what matters most.

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Future With State Farm

Your business thrives off your tenacity determination, and having great coverage with State Farm. While you lead your employees and make decisions for the future of your business, let State Farm do their part in supporting you with artisan and service contractors policies, commercial auto policies and business owners policies.

Let's discuss business! Call Bob Martin today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Bob Martin

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.